The Georgia State Charitable Contribution Program (GASCCP) belongs to you – the State of Georgia employee! It doesn’t belong to the government or even the charitable organizations that benefit from it. You control where your gift will go.

GASCCP provides employees the opportunity to make a difference in the lives of those in need – to help sustain community, state, national and international health, educational, environmental and human services.

The GASCCP offers employees choice, convenience and confidence!

- CHOICE: You get to direct your pledge to the organizations that are closest to your interest.

- CONVENIENCE: Workplace giving has advantages. Through payroll deduction you can give more, while only having a small amount deducted from each paycheck.

- CONFIDENCE: Each charity is screened by your peers. Requirements of each charity include: a Health and Human Service impact statement, IRS determination letter, Tax Form 990, and certified audits where appropriate.

You don’t have to go far to find people in need. Many of your family members, friends and neighbors will, at some point, benefit from the services of charities participating in the GASCCP. Whether it’s advances in medicine provided by research, support for our aging parents, disaster assistance or the opportunity for a child to participate in after school programs – we all have something to gain

by supporting the campaign.

Giving During Hard Times?

Although many of us would like to help others, giving a substantial amount all at once is not always possible especially during harder financial times.

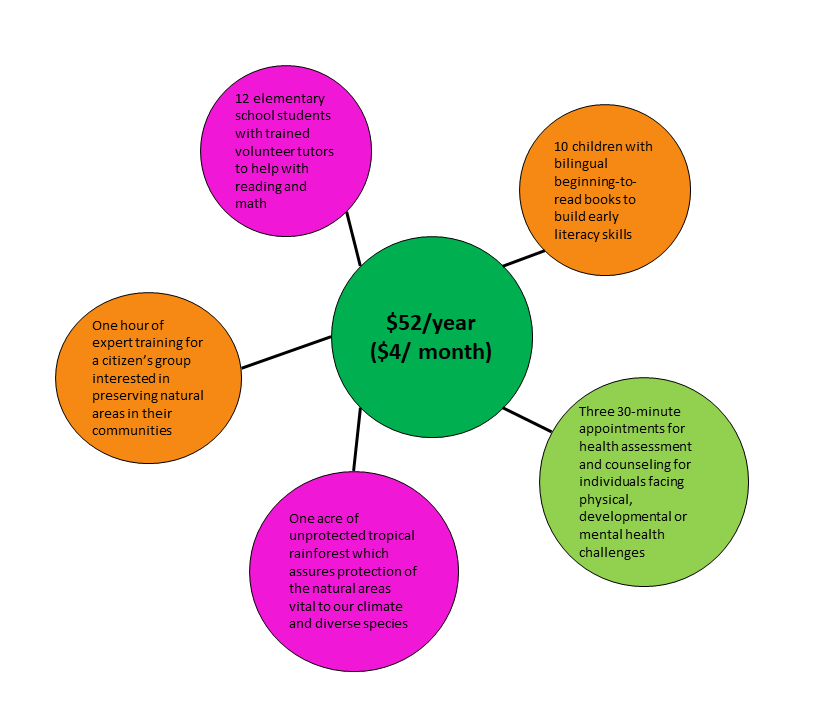

Through the GASCCP, you can make smaller donations throughout the year by payroll deduction. By spreading a small amount of your total donation out of each paycheck, allows you to make a large gift without ruining your budget.

A little at a time adds up to so much!